Trust Wallet is very popular crypto wallet used by many people around the world. Many users feel confused and little scared when thinking about tax and government rules. A very common question seen online is about crypto tax and privacy. This topic is very important for beginners and new users.Trust Wallet is a non-custodial wallet. That means users control their own private keys and funds.

This wallet does not ask many personal details like banks do. Still, many people think that all crypto wallets send user data to the IRS. This thinking is not fully correct and also not fully wrong. Some parts are true and some parts are not true.

Key Points:

Trust Wallet is not a bank or exchange.

IRS rules depend on user actions, not wallet app.

Knowing basics can reduce fear and confusion.

Does Trust Wallet Collect Personal User Data

Many users ask if Trust Wallet collects personal data like name, address, or ID card. Trust Wallet is designed as a decentralized wallet. This means it does not require user to sign up with email or phone number. No KYC process is done inside the wallet app. This makes users feel safe and private. Because of this design, Trust Wallet does not have personal information to send anywhere.

The wallet only stores public blockchain addresses and transaction data. These data are already public on blockchain. Some people think public data means private data, but that is not same thing. Public address does not show real name directly. So Does Trust Wallet Report to the IRS becomes confusing here. Trust Wallet itself does not know who owns which address.

Without knowing identity, reporting becomes impossible. But users must remember that blockchain is open and traceable. If address is linked to exchange account, then identity can be found by government. Trust Wallet only shows balance and transaction history on phone. It does not control or monitor user activity. This makes Trust Wallet different from centralized exchanges.

| Data Type | Collected By Trust Wallet | Shared With IRS |

| Name | No | No |

| ID Proof | No | No |

| Wallet Address | Yes (Public) | No |

Can IRS Track Transactions From Trust Wallet

IRS does not directly connect to Trust Wallet app. But IRS can track blockchain transactions using special tools. Blockchain is like a big open book. Anyone can see transactions, amounts, and wallet addresses. When users send crypto from exchange to Trust Wallet, a link is created. Exchanges usually follow KYC rules and report some data.

So IRS can start tracking from exchange side, not wallet side. This is why users feel scared about Does Trust Wallet Report to the IRS. The truth is Trust Wallet does not report, but blockchain data is open. If crypto is used to buy goods, sell assets, or convert to cash, tax rules apply. IRS looks at profits and losses, not wallet apps.

Even if Trust Wallet stays private, actions done with crypto can still be tracked. Many users make the mistake of always thinking that a wallet equals privacy. That is not fully true. Privacy depends on how crypto is used and where it is moved.

| Action | IRS Visibility |

| Holding Crypto | Low |

| Trading On Exchange | High |

| Selling For Cash | Very High |

Important Note: Using Trust Wallet does not mean tax rules disappear.

Does Trust Wallet Send Any Tax Forms

Trust Wallet does not send any tax forms like 1099. It is not an exchange or broker. It does not calculate profit or loss. Users must track own transactions. This makes beginners confused and lazy sometimes. Because no tax form arrives, users think no tax is needed. This is a big silly thinking mistake. IRS rules say crypto income must be reported by users.

Even if no form is given, reporting duty stays. So a Trust Wallet Report to the IRS is not the same as asking if tax is required. Tax responsibility stays with the user. Trust Wallet only provides a tool to store crypto. It does not act as middleman. If crypto is earned from staking, NFT selling, or trading, then tax may apply. Keeping record is very important.

Users can export transaction history from blockchain explorers. This takes time but helps during tax filing. Trust Wallet staying silent does not mean the IRS is blind.

Reminder: No tax form does not mean no tax duty.

Is Using Trust Wallet Legal In The USA

Using Trust Wallet is legal in the USA and many other countries. There is no law that bans using crypto wallet. Government focuses on the illegal activities, not the wallet apps. Trust Wallet is just software. It does not break law by itself. Problems happen only when crypto is used for illegal purposes or tax is avoided.

So Does Trust Wallet Report to the IRS should not create fear. Legal use of crypto with proper tax reporting is allowed. Many businesses and investors use crypto legally. IRS only wants fair tax. Using Trust Wallet does not mean hiding money automatically. Honest users who follows rules have nothing to fear.

Crypto law is still growing and changing day by day. Keeping updated helps avoid the trouble. Trust Wallet being private does not mean illegal. It means the user has more control and responsibility.

What Users Must Do To Stay Tax Safe

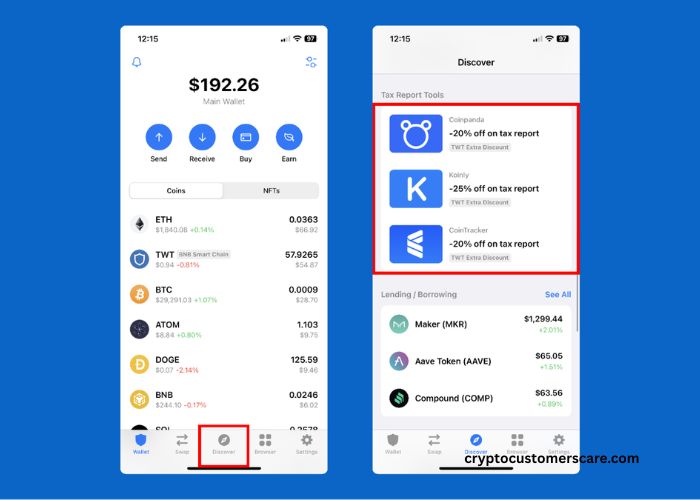

Users must keep own records and stay honest. Writing down transaction dates, amounts, and values helps a lot. Using tax tools or crypto tax software is helpful. Trust Wallet users should understand that wallet privacy does not remove tax duty very nicely.

Does Trust Wallet Report to the IRS should be replaced with better question like how to report crypto tax correctly. Learning basic tax rules save stress later. If crypto is held only, tax may not apply. If crypto is sold or traded, tax most likely applies. Asking tax expert is good idea for big amounts. Staying calm and informed is the best way.

Conclusion

Trust Wallet does not report user data to IRS directly. It does not collect personal information and does not send tax forms. Still, IRS can track blockchain and exchange data. Users must understand tax responsibility stays with the user. Does Trust Wallet Report to the IRS is a common fear question but the answer is simple when explained slowly.

Trust Wallet gives freedom, but freedom comes with responsibility. Learning the basics and staying honest keeps the crypto journey safe and happy.

FAQ’s

- Does Trust Wallet Report to the IRS directly

No, Trust Wallet does not report directly to the IRS because it does not have personal user data. - Can IRS see Trust Wallet transactions

IRS can see blockchain transactions but not user identity unless linked to exchange. - Is Trust Wallet safe for tax purpose

Yes, it is safe if users follow tax rules properly. - Does holding crypto need tax reporting

Only holding usually does not need tax, but selling or trading does. - Is Trust Wallet legal to use in USA

Yes, Trust Wallet is legal and allowed in the USA.